-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

555-555-5555

mymail@mailservice.com

contact us today

After over nearly 40 years as a licensed insurance agent, I think the reasons for a person driving uninsured falls into a couple of categories:

Number three (3) may be the most significant reason so many drivers become uninsured in the US.

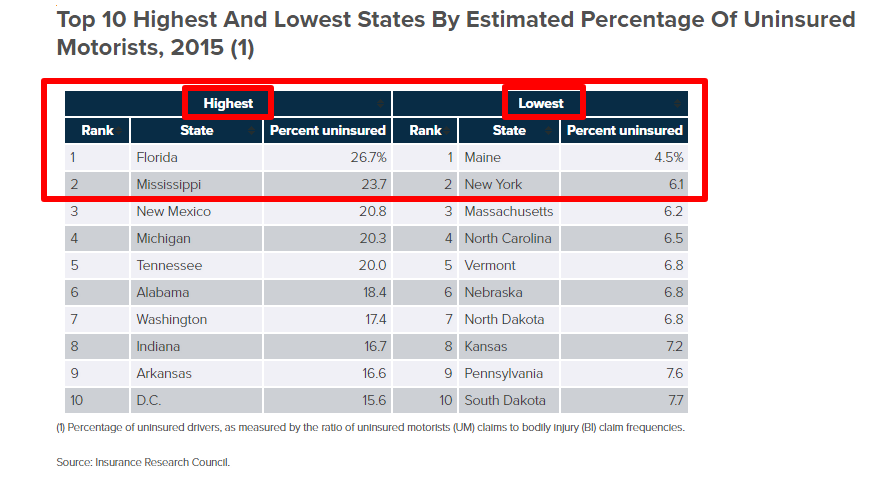

The Insurance Information Institute website charts that the highest percentage of uninsured motorists are in Florida and Mississippi. The lowest number of uninsured motorists are in Maine and New York [1].

As a resident and insurance agent in New York, I can speak to the significant consequences one faces if your car is left uninsured.

Here’s what an uninsured driver has to deal with in New York if they let their car insurance lapse:

An insurance lapse in New York comes with stiff fines, penalties, and consequences.

I know of many instances where people’s cars have been towed straight away from the side of the road after a citation by police when found they do not have proper insurance. Recovery of their impounded vehicle requires all fines and penalties be satisfied.

It doesn’t take long for citizens to learn that paying your auto insurance premium is not something you want to mess with. As a result, New York has some of the highest auto insurance compliance in the United States.

My guess is that uninsured drivers in Florida, Mississippi, New Mexico, Michigan, and Tennessee do not face the same kind of potential consequences.

About the Author: Jeff Ryan has been a licensed insurance agent since 1978, later becoming a full-time insurance professional in 1983. Since then, he has been the principal of The Ryan Agencies with offices in Hornell, Jasper, and Wellsville. The agencies serve approximately 15,000 clients in New York and Pennsylvania. Jeff holds numerous credentials including the Chartered Property & Casualty Underwriter (CPCU), Certified Insurance Counselor (CIC), Accredited Advisor in Insurance (AAI), Chartered Life Underwriter (CLU), and Chartered Financial Consultant (ChFC) designations. He holds a Master's Degree from the American College. Jeff enjoys writing about all things insurance and welcomes your questions and feedback.

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

This article may have been originally published at Quora.com.

To see Jeff's Quora.com profile click here.

Service@RyanAgency.com

Hornell: 607-324-7500

Jasper: 607-792-3800

Wellsville: 585-593-4244