-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

555-555-5555

mymail@mailservice.com

contact us today

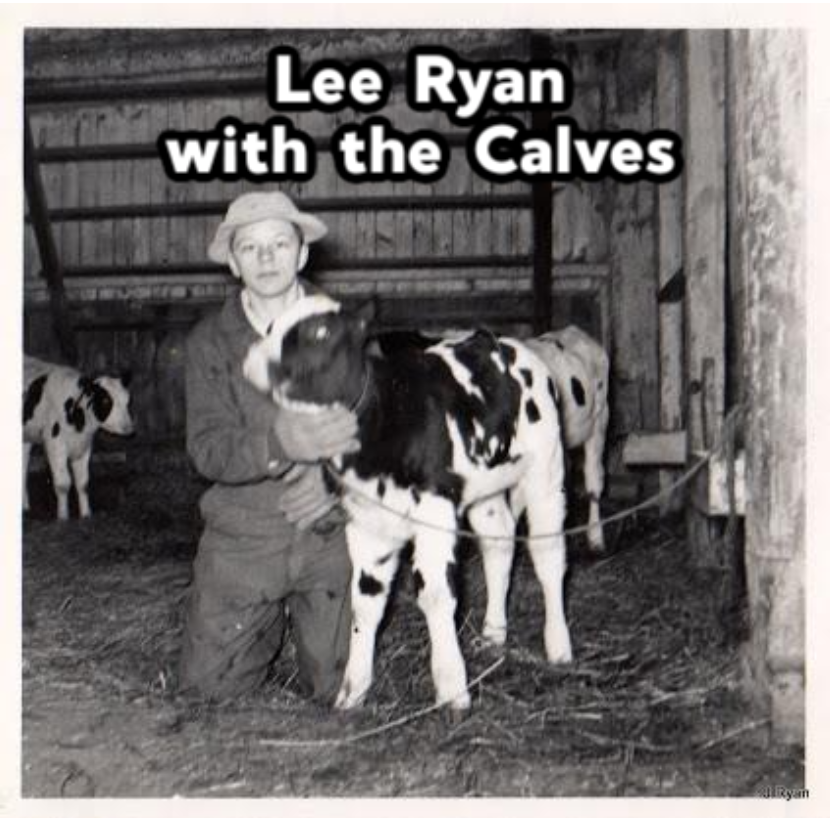

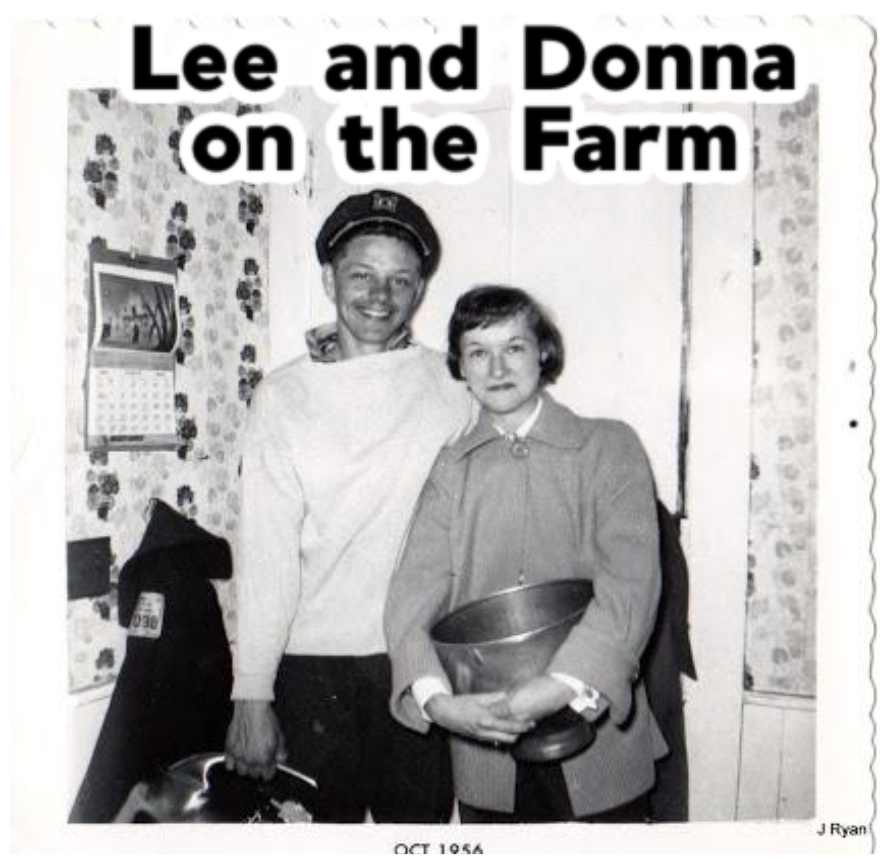

The year 1962 was marked by historic events—from the Cuban Missile Crisis to the passing of Marilyn Monroe. But while the world focused on these headlines, Lee A. Ryan was working alongside his brothers on my grandparents' farm when an unexpected opportunity arose—an invitation to join the insurance business. With no prior experience, no clients, and limited resources, my dad took a leap of faith and partnered with Nationwide Insurance to start an agency from scratch. Operating out of his home on Karr Valley Road in Almond, NY, he built his business one relationship at a time (some of whom are still clients!), laying the foundation for what would become a lasting legacy.

With no advertising budget at the start, he had to find creative ways to promote his new venture. One simplistic solution was an unconventional marketing tool by today’s standards - a metal sign attached to his car. The sign displayed his name, phone number, and the Nationwide Insurance brand he represented. The sign turned any trip while it was attached into an opportunity for visibility. Whether driving through town, attending community events, or meeting potential clients, it served as a moving advertisement, helping him establish the relationships that became the backbone of his agency.

As the business grew, my mom, Donna Ryan, played a crucial role in its success. She managed operations, handled customer service, and kept policies and paperwork in order, allowing my father to focus on sales and client meetings. Together, they built a business rooted in sound advice, integrity, and customer service, transforming a one-person operation into a well-regarded agency in the region.

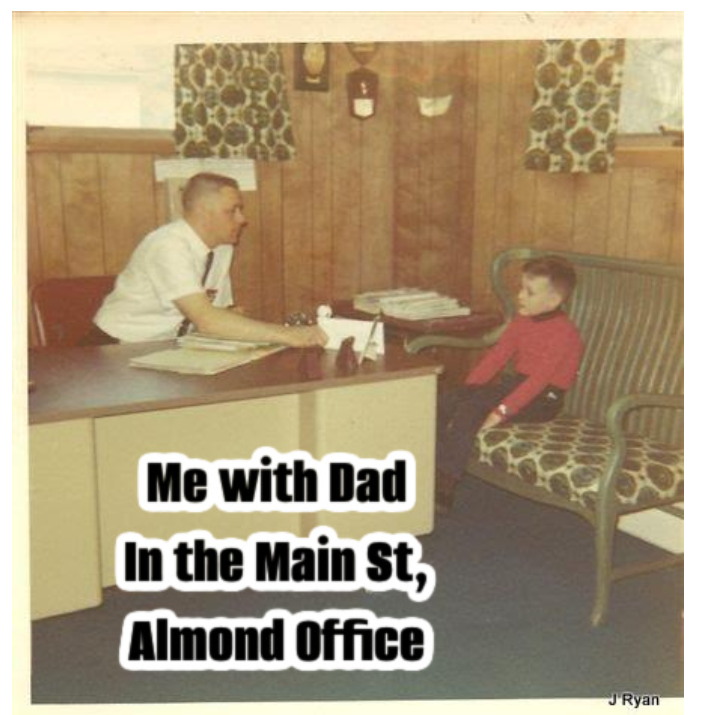

The agency expanded over time, and in 1994, my father retired and sold the business to me after I had a similar start as a scratch agent. By then, the original sign had long been forgotten, and its whereabouts were unknown.

That changed last month when a family friend, Duane Weldon—a former Nationwide Insurance agent himself—stumbled upon a surprising piece of history. While browsing Penny Lane Antiques in Waterloo, NY, he noticed a weathered metal sign bearing a familiar name. Recognizing its significance, he reached out to a family member. Thanks to Duane’s keen eye and efforts, the sign that once served as one of my dad’s original advertising tools was recovered—more than 60 years after it first hit the road.

Thanks to Duane, this long-lost sign has found its way home. More than just a piece of metal, it reminds us of the agency's genesis. Now, decades later, it’s back where it belongs, an artifact representing our simple origins and the dedication that carries us into the future.

While much has changed, we are deeply grateful to our dedicated past and current staff, who uphold the core values that built this agency. Integrity, sound financial guidance, and exceptional customer service remain at the heart of what we do. The principles my parents established continue to guide us forward.

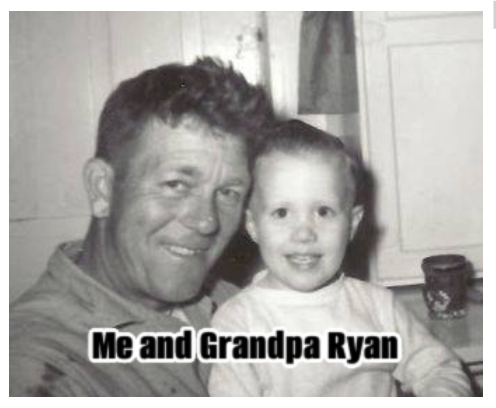

Postscript: This story affirms a legacy upon which our agency was built. My father carried forward the values of hard work, perseverance, and service that were born out of my grandparents' farm. His dedication to building this agency from the ground up, alongside my mom, shaped not only our business but also the way we serve our community.

I’ll leave two more photos that relate to this article: one of me with my grandfather on the above mentioned farm and another of my father and me in his then-new and modern office on Main Street in Almond.

We’re fortunate to have uncovered some history, but we realize none of this success would have happened without the loyalty and support of the many clients who have been part of this journey.

Our deepest thanks to all who had a hand in shaping our history. We look forward to many more years of carrying on and serving you all!

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

This article may have been originally published at Quora.com.

To see Jeff's Quora.com profile click here.

Service@RyanAgency.com

Hornell: 607-324-7500

Jasper: 607-792-3800

Wellsville: 585-593-4244