-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

555-555-5555

mymail@mailservice.com

contact us today

I love this question because it doesn’t include the familiar words “required to” or “need to” have.

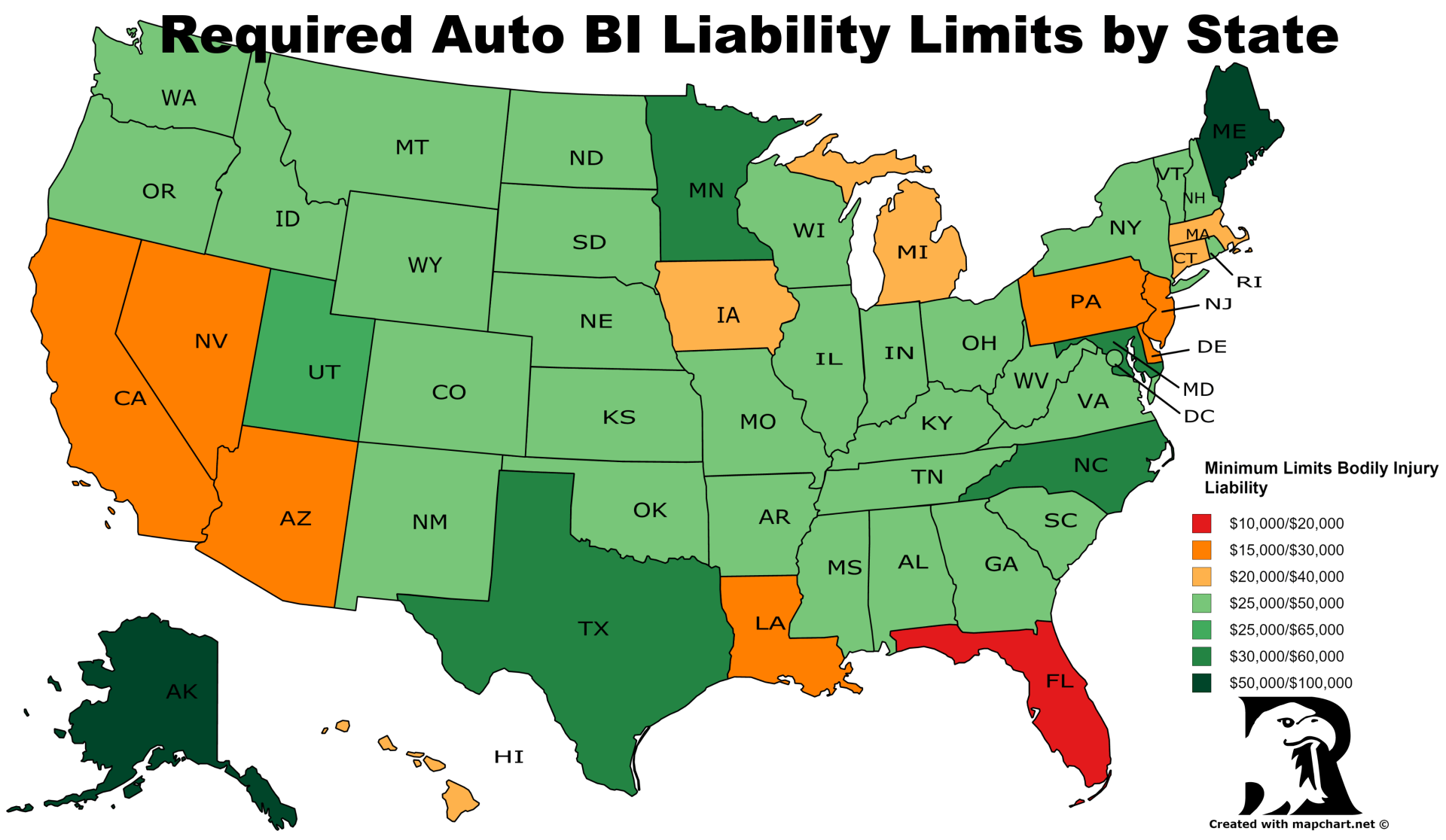

When one asks how much auto liability coverage am I “required” or “need to” have, people generally point to the legal requirements of each state. Little do most know that minimum state liability requirements have not changed in decades.

Suffice it to say, the current limits required by the majority of states are woefully inadequate for any motorist.

The question of what is a "responsible" amount of liability coverage begs an entirely different perspective.

A “responsible” amount of liability insurance coverage would be an amount that protects one from potential exposure to loss and provides those you injure reasonable compensation.

LIABILITY LIMIT = NET WORTH?

A common misconception is one’s limit of liability coverage should reflect the value of your current net worth. The Median Household Net Worth of people under the age of 35 ( a

s of the last posting by the US Census Bureau was $6,676

). That number would not even meet the low limits required by most states.

Those of middle age (45 to 54) show an average net worth of $84,542. However, neither number are something to base an auto insurance liability limit.

Net Worth may be a motivator for an opposing attorney, but it does not reflect your potential exposure to loss. Nor does it consider the social responsibility to those you might injure.

So how should we determine an appropriate limit of liability coverage on my auto insurance?

WHAT IS MY POTENTIAL EXPOSURE TO LOSS?:

The old adage, "you don't have to be a millionaire to be sued like one" certainly holds true. The unfortunate circumstance of injury to others resulting in the loss of life enjoyment, companionship or the capacity to earn a living happens to those from all walks of life.

So what is my potential exposure to loss?

Following an accident with injury or damage to others, one stands to lose:

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

This article may have been originally published at Quora.com.

To see Jeff's Quora.com profile click here.

Service@RyanAgency.com

Hornell: 607-324-7500

Jasper: 607-792-3800

Wellsville: 585-593-4244