-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

555-555-5555

mymail@mailservice.com

contact us today

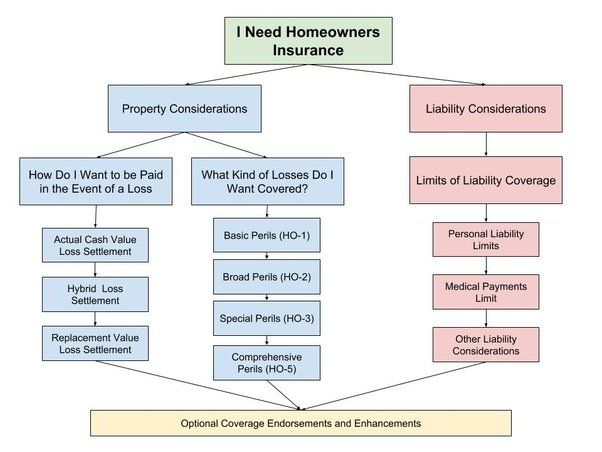

To try and boil down the considerations for purchasing homeowners insurance to one thing is to discount the importance of the product.

Homeowners insurance provides coverage for the real estate you are purchasing, personal belongings, and compensation for replacement property if the home is destroyed. Within the property portion, one can select how

they are paid for those coverages.

Equally if not more important, a homeowners policy is the source of coverage for the exposure to large personal liability claims.

A basic decision tree outlining some of the major

decision considerations for homeowners insurance purchase is included in the graphic at the end of this article.

One of the most important considerations when purchasing homeowners insurance will determine how

the policy will pay

for property losses. That consideration will be tied to the limit chosen for the dwelling. However, it can be trickier than that.

Knowing the difference between Actual Cash Value

, Replacement Value

and the hybrid loss settlement options

available will arm a homeowners insurance shopper with insight that will help in the decision making process.

Property coverage considerations may be the most unique

aspect of a homeowners insurance product, yet not the largest

exposure. Liability losses represent the potential for the largest financial loss. So, don’t forget to stack the liability section of the policy with generous limits of coverage as well!

Come to think of it, maybe the number one thing to consider when purchasing homeowners insurance is to seek quality advice from a qualified insurance agent to help you walk through the decision making process. Need additional assistance with your Homeowners Insurance? We LOVE to help! Please feel welcome to stop in and see us at our office nearest to you or call us at 607-324-7500

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

This article may have been originally published at Quora.com.

To see Jeff's Quora.com profile click here.

Service@RyanAgency.com

Hornell: 607-324-7500

Jasper: 607-792-3800

Wellsville: 585-593-4244