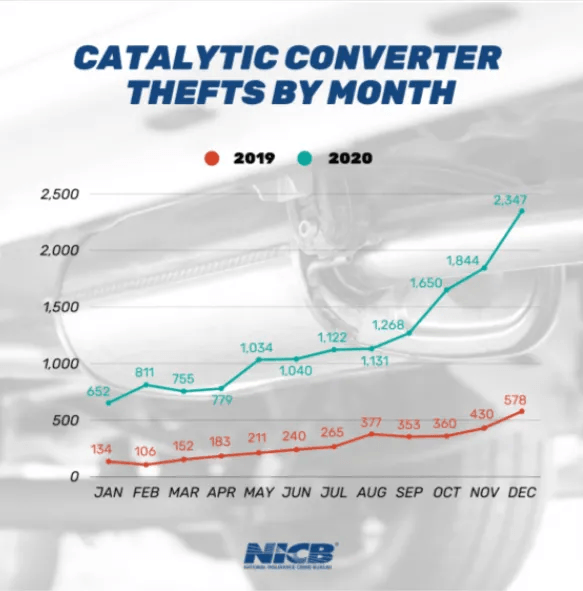

The National Insurance Crime Bureau reports that catalytic converter theft soared from 282 a month in 2019 to 1,203 in 2020. The latter part of 2020 saw thefts increase above 2,000 per month.

Removing a catalytic converter takes only a few minutes with the right tools.

Unfortunately for the victim, the repair cost can cost between $1,000 and $3,000.

Measures to combat this crime involves can include:

Park in a garage or secure parking area.

Install bright, motion sensor lights to discourage thieves.

Always lock your vehicle and set an alarm.

Install an anti-theft device.